Home Security Equipment LTV Price Estimator

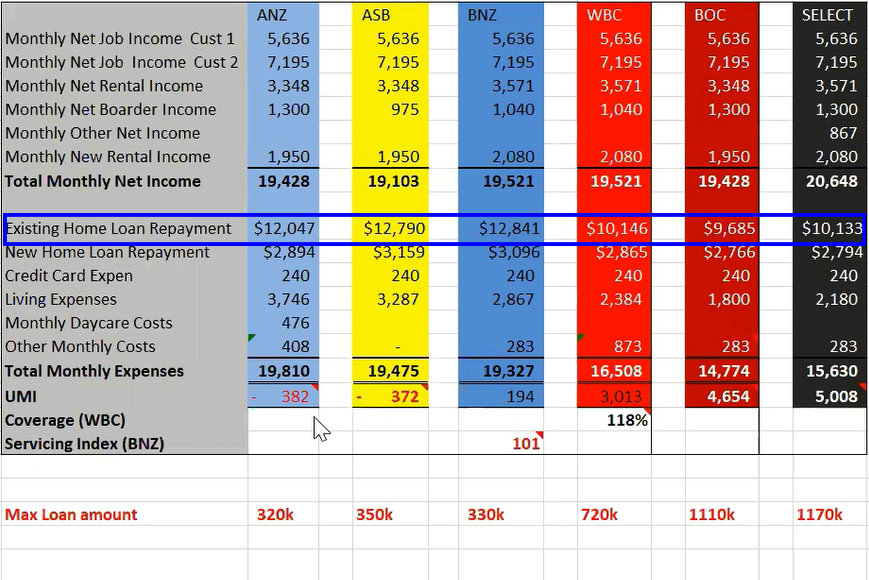

Loan providers use this advice to guess how much you can afford so you can obtain when you are making certain you can comfortably manage your loan borrowing power calculator payments rather than overstretching your bank account. The newest calculator finds your own estimated credit strength from the subtracting expenses and you will existing loans from your own net income (income after taxation). Of numerous points can also be determine the expenses, and family your financially assistance, established financial obligation, or other financial obligations, just like your medical health insurance coverage. Their borrowing skill tend to be realistic for individuals who enter direct info to the calculator, therefore you should begin by analysing your own expenditures. Your own cost of living and subscribe to calculating their borrowing energy, as these costs imply your ability and then make loan payments. Having a hefty deposit will not ensure it will be possible to settle the loan, for this reason lenders and check your individual and you will members of the family income and you can expenses.

Exactly how much would you use when you yourself have a deposit?: borrowing power calculator

Assess costs, rates and see just how much credit electricity you actually have. What you could easily pay for compared to. what you are able obtain may be various other. Your own monetary things and wants may vary away from individual to help you people. It’s crucial that you take the time to evaluate your monetary situation, consider carefully your quick-term and you may long-label requirements and make decisions you to definitely line-up with your problem and objectives. Repeating monthly mortgage expenses for example pupil, car, and bank card money. How much home loan you are acknowledged to own hinges on your own earnings, loans, deposit, total monthly expenditures and also the form of mortgage.

Right here, we fall apart what credit electricity are, how it’s calculated and you will, if it’s perhaps not in which you want it to be, the best way to strive to raise it. Whether it’s an investment or another household, you’re thinking just how much your’ll have the ability to spend since the a first-house customer – in other words, your own credit electricity. Loan to help you Really worth ratio (LVR) is the complete matter you may have lent to suit your loan while the a portion of your home really worth. Minimal borrowing number is $10,000 becoming qualified to receive a mortgage.

Imagine your home well worth within the three simple steps

To possess a more intricate dialogue and to speak about next tips, talk to one of our financial specialists. The newest borrowing from the bank power calculator was created to guess anything you have the ability to acquire without the need to generate a mortgage software. However, the results are not guaranteed and ought to simply be used as the an excellent publication. For a more expansive writeup on their borrowing strength and you will sensible borrowing from the bank information, we recommend calling one of our Credit Pro. The new ANZ Home loan payment calculators render a simple imagine out of exactly what your mortgage payments will be to have an alternative financing otherwise will allow you to examine other scenarios if you have a current mortgage. When evaluating their credit electricity, i look at the power to comfortably meet fees requirements.

Contrast the expenses out of renting versus. to buy

That have in initial deposit Raise financing, you can get on the property ladder for just step one.1% – dos.2% initial. We are going to shelter their 20% deposit—you select an informed financial and you will say goodbye to renting. This post is general in nature possesses been waiting instead of getting your expectations, issues and requirements into account.

This will make your repayments more costly also it can restrict how much you could potentially borrow. After the repaired several months, your own rates usually change to the newest relevant variable rate for a great prominent and you may interest mortgage. Such, if you have aggressive school and you can old age savings preparations, have you been able to keep storing up currency at that pace for those who have increased financial? Or perhaps you’re starting on your career and you may greeting your income have a tendency to notably raise in this many years. The debt-to-money proportion (DTI), just like your credit history, plays a role in deciding your home loan qualification.

Financial credit calculator

Any suggestions about the webpages has been prepared instead of considering the objectives, financial predicament or requires. Prior to performing on any suggestions, consider should it be befitting your circumstances to see the newest Equipment Revelation Statement or Small print available on the net otherwise by contacting united states. Credit software is susceptible to credit assessment conditions. Customers Determinations for our products are available at nab.com.au/TMD. With this user friendly credit electricity calculator, you can view just how much you might be in a position to acquire for your house loan. Merely get into your income and you can expenses and you may any existing mortgage costs.

Contact us to possess mortgage associated inquiries

Which shape assists lenders determine whether you can manage a lot more home loan payments. A lower DTI can also be signal financial balances, making it easier so you can qualify for a mortgage. You will need to imagine some can cost you outside of the mortgage payments after you have went inside, such as council prices, strata charges, bills, insurance, and property maintenance. With this in mind, think about your earnings and you may expenses as well as the matter we would like to spend and ensure that you build an authentic choice which can be appropriate for the lifetime of the mortgage. Since the rates of interest increase, along with a variable rate home loan, your payments usually increase too. The total amount a lender is actually willing to provide are sooner or later right up on their discretion, however, fundamentally comes to considering its earnings immediately after expenses and you will mortgage costs.